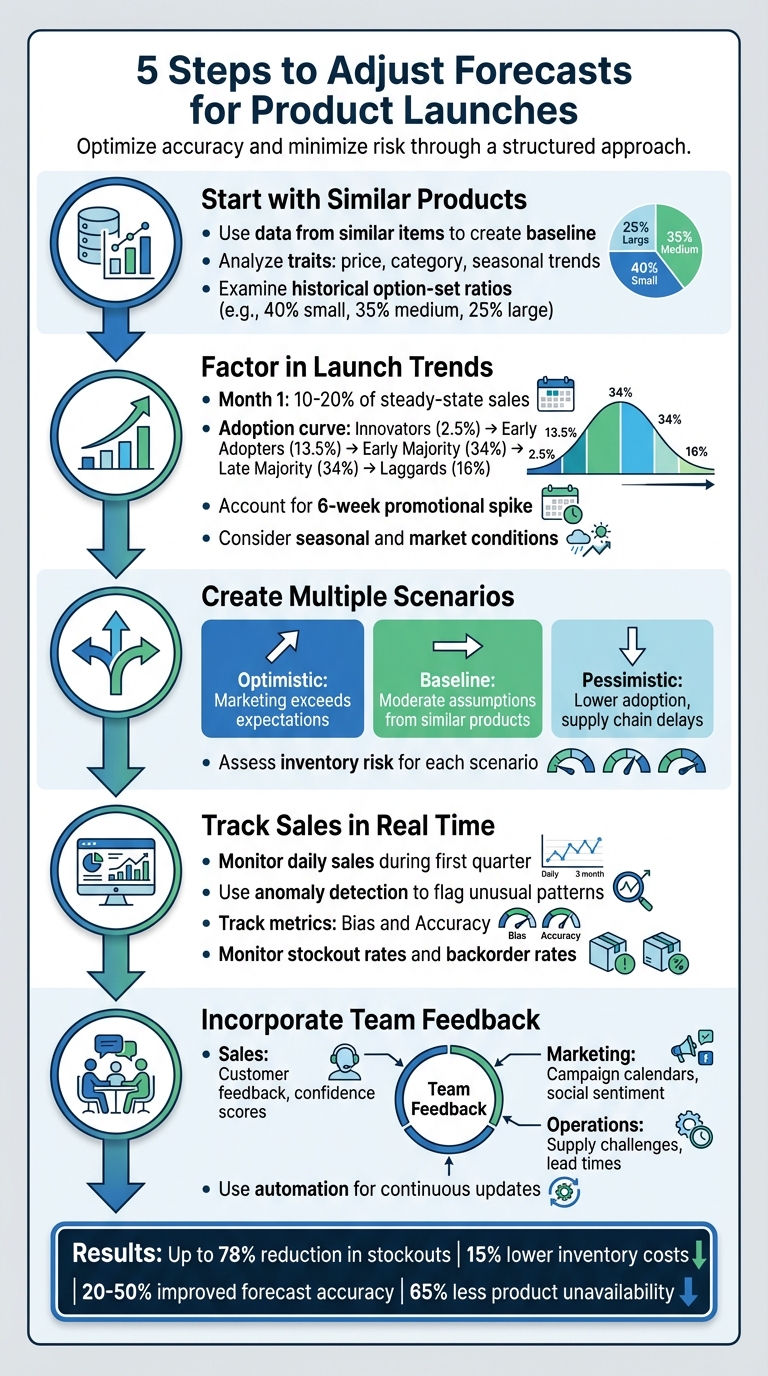

Launching a new product is tricky without sales history to guide you. Misjudging demand can lead to costly stockouts or excess inventory. To avoid these pitfalls, follow these five steps:

- Start with Similar Products: Use data from similar items to create a baseline forecast. Tools like Forthcast can analyze traits like price, category, and seasonal trends to predict performance.

- Factor in Launch Trends: Account for ramp-up sales patterns and external factors like market conditions or seasonal demand.

- Create Multiple Scenarios: Develop optimistic, baseline, and pessimistic forecasts to prepare for varying outcomes.

- Track Sales in Real Time: Monitor daily sales to spot deviations early and adjust strategies. Use tools like Forthcast for anomaly detection and tracking lost sales.

- Incorporate Team Feedback: Combine AI-driven insights with input from sales, marketing, and operations teams for more refined forecasts.

5-Step Process for Adjusting Product Launch Forecasts

Forecasting Sales for New Products: Step-by-Step Guide (Fashion, Innovations, Financial...)

Step 1: Build a Starting Forecast Using Similar Products

When you're launching a new product without any sales history, the best place to start is by looking at data from similar, well-performing products. This approach uses real-world performance data to create a baseline forecast for your new item.

Select Products with Matching Characteristics

Start by identifying existing products that share important traits with your new launch. These traits might include seasonal demand, category, price range, or target customer demographics. For example, by analyzing sales data from similar products, you can spot purchasing trends throughout the year and get a clearer picture of potential demand.

Take it a step further by examining historical option-set ratios, like the percentage of sales across different sizes (e.g., 40% small, 35% medium, 25% large). Use these ratios to guide your initial inventory decisions. If your new product is a direct replacement with minor tweaks - like switching from a 2 oz bottle to a 2.1 oz version - you can combine the previous product’s sales history with the new SKU to create an instant starting point for your forecast. This baseline will serve as the foundation for more refined predictions using advanced tools.

Use Forthcast's Product Substitution Feature

Forthcast provides a powerful tool for SKU-level analysis, designed to help you predict performance for new products that lack historical data . By analyzing characteristics like color, material, price, and style, Forthcast can estimate how a new SKU might perform based on trends from similar, mature products . It even factors in details like lead times, variant data, and seasonal trends to create a more precise forecast . Plus, it evaluates the potential "cannibalization effect", predicting how the new product might impact sales of your existing items.

This combination of historical data and predictive analysis ensures your forecast is grounded in real insights, giving you a solid starting point for your new product launch.

Step 2: Account for Launch Patterns and Market Conditions

Once you've established a baseline from similar products, it's time to fine-tune your forecasts to reflect the realities of launching something new. New products rarely hit their peak sales right out of the gate - they tend to follow certain predictable trends that should be factored into your projections.

Plan for Launch Phase Sales Patterns

Sales for new products typically start small and grow over time. A common way to model this is by using a ramp-up curve. For example, in the first month, sales might only reach 10–20% of your expected steady-state levels. Over the following months, sales increase as more customers become aware of the product. This pattern aligns with the adoption curve, where innovators (2.5% of buyers) and early adopters (13.5%) lead the way, followed by the early majority (34%), late majority (34%), and finally, laggards (16%).

It's also important to avoid mistaking a short-term spike for long-term demand. Many products see a six-week surge after launch, often fueled by promotional campaigns or initial buzz. However, this is usually followed by a drop-off. Misinterpreting this temporary boost can lead to inaccurate long-term projections. After the first 2–3 months of sales, you should transition from theoretical models to data-driven ones, such as linear regression or exponential smoothing, to better capture your product's actual performance.

But launch dynamics aren't the only factor - external conditions also play a big role in shaping demand.

Factor in Seasonal and Market Trends

External factors can significantly influence your product's launch performance. Broader economic conditions, competitor actions, and seasonal trends all impact how quickly customers adopt your product. For instance, Peloton experienced a massive 172% sales increase in September 2020, driven by pandemic-related gym closures.

To refine your projections further, tools like Forthcast's custom forecast enrichments can help you layer in these external variables. Think about seasonal demand cycles (like holiday shopping booms), promotional campaigns, or shifts in market dynamics. These adjustments ensure you’re prepared for high-demand periods without overstocking or underestimating inventory when the market shifts unexpectedly. By understanding how each variable impacts your forecast, you can make smarter, more informed decisions.

Step 3: Develop Multiple Forecast Scenarios

When launching a product, it’s impossible to predict the future with absolute certainty. That’s why creating multiple forecast scenarios - optimistic, baseline, and pessimistic - is such a smart move. These scenarios give you a clearer picture of how different factors might influence your launch and help you stay prepared for unexpected turns.

The idea is to test your core assumptions against various possibilities. Think about what might happen if your promotions don’t perform as planned, if competitors adjust their pricing, or if demand surges beyond your expectations. By modeling these possibilities, you can make better inventory decisions and avoid being caught off guard.

Test How Variables Affect Demand

Start by identifying the key factors that could impact demand during your launch. These might include pricing strategies, marketing spend, promotional efforts, competitor behavior, or even broader economic trends. For each scenario, adjust these variables to reflect different market conditions.

- In an optimistic scenario, assume your marketing efforts exceed expectations, creating buzz among early adopters and driving stronger sales.

- For the baseline scenario, rely on moderate assumptions, using data from similar products you analyzed earlier in Step 1.

- In a pessimistic scenario, plan for challenges like lower adoption rates or delays in your supply chain.

To make this process efficient, use real-time modeling tools to test different iterations quickly. Bring together a team from marketing, sales, and operations to collaborate on refining these scenarios. It’s also a good idea to create detailed daily forecasts for the first quarter so you can adjust swiftly based on actual sales trends. These scenarios will not only guide your launch strategy but also help you assess inventory risks.

Use Scenarios to Assess Inventory Risk

Once you’ve tested your variables, compare the scenarios to understand potential inventory risks. For instance, if your pessimistic scenario predicts demand falling well below the baseline, you’ll need to calculate the potential costs of excess inventory - things like storage fees and tied-up capital.

To avoid unnecessary losses, establish a clear failure threshold for your product. If demand doesn’t meet this threshold, be ready to cut your losses early. As Anaplan points out:

A high proportion of new products fail, and it is better to pull the plug on an ailing new product that is unlikely to achieve a viable level of profitability at the earliest opportunity.

This approach keeps emotions out of decision-making and ensures you act decisively if the product underperforms.

At the same time, be prepared to scale up if demand exceeds expectations. Backorders can serve as a helpful strategy to maintain customer engagement while you gather more data and ramp up production. This way, you’re ready to adapt regardless of how the launch unfolds.

sbb-itb-499c055

Step 4: Track Sales Performance and Detect Outliers

After your product hits the market, it’s crucial to keep a close eye on how actual sales compare to your forecasts - in real time. Spotting deviations early allows you to tweak your inventory strategy before minor issues snowball into costly mistakes. This level of monitoring enables precise, daily adjustments that can make or break your launch.

Revisit and update your forecasts daily during the first quarter of your launch. Early demand trends can reveal a lot. Just a few days of unexpected sales activity might indicate you're heading toward a stockout or, on the flip side, dealing with surplus inventory.

Use Forthcast's Anomaly Detection

Forthcast’s anomaly detection tool is designed to flag unusual sales patterns as they happen. Not every spike or dip in sales is worth reacting to - sometimes, a viral post causes a temporary surge that doesn’t reflect a long-term trend. This tool helps you separate one-off anomalies from patterns that genuinely require action, so you don’t overcorrect based on fleeting events.

Another key feature is its ability to track lost sales opportunities - something that’s often invisible. For instance, when a product is out of stock, you lose insight into how many customers wanted to purchase it. However, if you enable backorders during a stockout, you can capture this data and use it to refine future forecasts.

Measure Forecast Accuracy Over Time

Evaluating how well your forecasts perform isn’t optional - it’s essential for improvement. Forthcast tracks two critical metrics: Bias (whether you’re consistently over- or under-predicting) and Accuracy (how far off your forecasts are from reality). If you notice a consistent bias, it’s a sign that there’s a deeper issue in your forecasting process that needs attention.

"The less accurate your forecasts are, the more problems your company will likely run into." – Adii Pienaar, Founder, Cogsy

During your launch, focus on metrics like stockout rates, backorder rates, and the gap between forecasted and actual sales. These numbers will show whether your initial assumptions were on target - or if it’s time to adjust.

With these real-time insights in place, the next step is to bring in feedback from your team to fine-tune your forecasts even further.

Step 5: Update Forecasts with Team Input

Forecasts get better when they’re enriched with real-time insights from your team. While AI can excel at analyzing historical data and spotting trends, it often falls short when it comes to capturing the nuances of real-time customer feedback or qualitative insights. This is why collaboration across teams is so important - especially during a product launch when historical data may be limited. By combining automated tools with input from your team, you can set the stage for more accurate and dynamic forecasting.

Gather Insights from Different Teams

Create a launch working group that includes representatives from key departments like sales, marketing, operations, and product management. This group should meet regularly - daily or weekly, especially in the critical first weeks - to share observations that data alone might miss.

- Sales teams bring direct customer feedback to the table. They can share insights about the buyer's journey, common objections, and the features driving sales. They’re also in a position to assign confidence scores to pipeline deals, helping you separate “maybe interested” from “ready to buy”.

- Marketing teams can provide context around campaign calendars, planned discounts, and social media sentiment. For example, if a major influencer partnership or promotional campaign is in the works, this can signal a potential demand surge that should be factored into the forecast.

- Operations teams help identify supply-side challenges, such as material shortages, supplier delays, or longer lead times. This ensures your sales targets stay grounded in what’s actually achievable.

By blending these qualitative insights with quantitative data, your forecasts become far more robust. This kind of cross-functional input can help avoid costly mistakes and misalignments.

"Sales teams are the eyes and ears of your company. They're the ones who interact with your customers on a regular basis." – Adii Pienaar, Founder of Cogsy

Once your team’s insights are integrated, automation can take over to keep your forecasts updated and accurate.

Use Forthcast's Automation for Continuous Updates

After incorporating team feedback, let automation handle the heavy lifting. Forthcast uses machine learning to continuously refine forecasts, identifying patterns and adjusting demand predictions for a six-month horizon.

The system is designed to recognize demand spikes and account for past stockouts, ensuring your forecasts reflect what customers wanted - not just what was available. Additionally, smart reorder alerts notify your team before stockouts happen, allowing for timely restocking. This approach can significantly improve forecasting accuracy, reducing errors by 20%–50% and cutting product unavailability by as much as 65%.

Conclusion

Launching a new product without historical data doesn’t mean you’re flying blind. By following these five steps - using forecasts from similar products, factoring in launch trends, creating scenarios, monitoring outliers, and incorporating team feedback - you can establish a solid framework to manage the unknowns.

Dynamic forecasting takes this process a step further, bridging the gap between uncertainty and smarter inventory management. The shift away from static spreadsheets to real-time, adaptive systems is key. Tools like Forthcast leverage machine learning to refine forecasts over a six-month period. They can automatically detect demand surges and adjust for stockouts - something traditional models often overlook. And the results speak for themselves: machine-learning-driven forecasting can cut stockouts by up to 78% and reduce overall inventory carrying costs by 15%.

"Accurately estimating consumer demand is the essential first step to optimizing inventory investments." – Retalon

FAQs

How can I use historical data from similar products to forecast a new product launch?

Leveraging past data from similar products is an effective way to craft a precise forecast for a new product launch. Start by pinpointing previous products with similar traits - think category, price point, target audience, seasonality, and marketing strategies. Use their sales figures as a foundation, ensuring the data is clean and reliable, especially at the SKU level.

To make comparisons meaningful, normalize the data by aligning it to a consistent scale, such as units sold per $1,000 of price or marketing spend. Adjust timelines to reflect the product launch phase rather than specific calendar dates, enabling a clearer view of sales trends. Pay closer attention to recent or closely matched products, and tweak the data to account for differences like pricing or lead times.

For an even sharper forecast, consider using AI tools like Forthcast. These tools can analyze normalized data, flag anomalies, and factor in external elements like promotions or seasonal shifts. The result? SKU-level projections with confidence intervals that you can fine-tune to reflect anticipated changes, like a marketing push. During the launch, regularly compare actual sales to your forecast. This lets you adjust on the fly, helping to avoid stock shortages or excess inventory.

What external factors should I consider when adjusting forecasts for a new product launch?

When preparing a forecast for a new product launch, it's crucial to account for external factors that could heavily influence demand. Start by evaluating market trends, including consumer interests, emerging patterns, and the size of your target audience. Don’t overlook seasonality - holidays, weather-related buying habits, or back-to-school shopping periods can all play a big role. And then there are macroeconomic conditions, like inflation, disposable income levels, and consumer confidence, which can shape purchasing behavior.

Keep a close eye on what your competitors are doing, too. New product launches or pricing changes from rivals can disrupt your plans. On the operational side, think about supply chain factors - lead times, supplier capacity, and potential shipping delays could all affect your ability to meet demand. Finally, factor in any planned marketing campaigns that might temporarily spike interest and sales.

By thoroughly analyzing these elements early on, you’ll be better equipped to fine-tune your forecast, anticipate demand shifts, and minimize risks like running out of stock or overproducing during the critical launch phase.

Why is it important to create multiple forecast scenarios for a new product launch?

Launching a new product comes with a unique challenge: predicting demand without any historical sales data to rely on. That’s why creating multiple forecast scenarios - such as best-case, average-case, and worst-case projections - is so important. These scenarios help you anticipate how different demand levels might affect critical areas like inventory, cash flow, and service levels. With this insight, you can prepare for potential stockouts or overstock situations before they become problems.

This method also gives you the chance to test key assumptions, like how well your marketing will perform, how seasonal trends might influence demand, or how supply chain lead times could impact availability. As real-world data starts rolling in, these forecasts can be refined to stay aligned with actual performance. Tools powered by AI, like Forthcast, make this process even easier by generating and comparing forecasts automatically. They provide detailed SKU-level insights and flag significant shifts in sales patterns, helping you reduce risks, streamline inventory, and ensure a smoother product launch.