AI is changing the way businesses manage buffer stock, moving from outdated formulas to dynamic systems. Here's what you need to know:

- Buffer stock: Extra inventory to handle demand spikes or supply delays.

- Old methods: Rely on static formulas like EOQ and ROP, which assume consistent demand and lead times. These can lead to overstocking or stockouts.

- AI-driven systems: Use real-time data and machine learning (e.g., LSTM, GBM) to adjust stock levels continuously. This includes factors like weather, promotions, and supplier performance.

- Benefits: Companies report up to 30% lower inventory costs, 20% fewer logistics expenses, and a 65% drop in stockouts.

AI tools like Forthcast fine-tune stock levels daily, improving accuracy and reducing waste. By integrating real-time data and predictive algorithms, businesses can balance availability and cost more effectively than ever.

Demand Forecasting for Inventory Management with AI | Prevent Overstocking and Wasted Cost!

Traditional Buffer Stock Calculation Methods

Traditional approaches for calculating buffer stock rely on fixed mathematical formulas and historical sales data. Below, we explore these methods and their inherent limitations.

Safety Stock Formulas

The formula for calculating safety stock is:

Safety Stock = (Z-score) × (Standard deviation of demand) × (√Lead time).

The Z-score indicates the desired service level. For instance, a Z-score of 1.96 corresponds to a 95% service level, meaning there's only a 5% chance of running out of stock. While useful, these formulas fail to account for changing market dynamics and fluctuating demand patterns.

Retailers also utilise methods like Reorder Point (ROP) and Economic Order Quantity (EOQ). The ROP formula determines when to reorder stock based on average demand and lead time:

ROP = (Average demand per period) × (Lead time in periods).

Meanwhile, EOQ focuses on finding the order size that minimises total costs by balancing ordering and holding expenses:

EOQ = √((2 × Demand × Ordering cost) ÷ Holding cost).

Other techniques include time-series models such as the Simple Moving Average (SMA), which smooths short-term fluctuations by averaging demand over a fixed number of past periods. Exponential Smoothing, on the other hand, gives more weight to recent sales data, allowing forecasts to adapt more quickly to emerging trends. Many businesses still rely on static reorder thresholds in spreadsheets, which trigger stock replenishment when inventory falls below a predefined level.

| Statistical Model | Calculation | Best Use Case |

|---|---|---|

| Moving Average | Sum of past periods ÷ number of periods | Stable demand with minimal seasonality |

| Exponential Smoothing | Ft+1 = α × yt + (1 – α) × Ft | Products with trends or moderate seasonality |

| Seasonal Decomposition | Demand = Trend + Seasonal + Residual | Industries driven by seasonal demand |

| Regression Analysis | Y = a + bX | Analysing demand based on variables like price |

Limitations of Conventional Methods

While these methods provide a starting point, they come with substantial limitations. The most significant drawback is their reliance on static assumptions. Most models presume that lead times and demand remain constant, which isn’t realistic. This rigidity can lead to stockouts during disruptions or excess inventory during slow periods.

Traditional techniques also struggle to adapt to real-time shifts in demand, often resulting in inefficiencies when the market experiences sudden changes. For example, inventory accuracy in U.S. retail averages just 63% when using these methods. Additionally, around 43% of businesses report losing sales opportunities due to poor inventory forecasting.

Time-series models like moving averages are particularly limited because they act as lagging indicators. While they smooth past demand fluctuations, they fail to predict abrupt changes or seasonal peaks. Similarly, EOQ assumes demand is deterministic - predictable and constant. In reality, demand is stochastic, meaning it’s random and often follows complex, unpredictable patterns that simple calculations cannot fully address.

As businesses grow, managing inventory with manual spreadsheet updates becomes increasingly impractical and prone to errors. These traditional tools also suffer from siloed data, as they don’t integrate real-time inputs like marketing signals, cross-channel sales, or external market trends. This lack of integration can lead to cash being tied up in slow-moving products, while high-demand items frequently run out.

How AI Improves Buffer Stock Calculation

AI is revolutionising buffer stock management by shifting away from rigid, static formulas. Instead of assuming that demand and lead times remain consistent, AI systems adapt in real time. These models continuously learn and adjust stock levels, effectively addressing one of the biggest flaws of traditional methods - their inability to respond quickly to sudden market fluctuations or supply chain disruptions. Let’s take a closer look at how machine learning addresses demand variability.

Machine Learning for Demand Variability

Machine learning (ML) algorithms excel at identifying intricate patterns that traditional models often miss. Techniques like Long Short-Term Memory (LSTM) networks and Gradient Boosting Machines (GBM) analyse historical data to uncover non-linear trends and seasonal variations that simple averages fail to capture. Unlike conventional forecasting methods, which often reduce demand variability to a single standard deviation, ML uses probabilistic distributions to reflect the multifaceted nature of customer behaviour.

The impact of AI on forecasting can be dramatic. Companies adopting these technologies often see forecasting accuracy jump from 60% to 80%, alongside a 20% to 30% reduction in overall inventory levels. What sets ML apart is its ability to incorporate external factors that traditional methods overlook - things like weather conditions, social sentiment, promotional schedules, and geopolitical trends. By analysing these external signals, AI adjusts buffer stock proactively, mitigating risks before they escalate into stockouts. Static reorder points are replaced with dynamic thresholds that adapt instantly to demand surges or supplier delays.

Real-Time Data Integration

AI systems thrive on real-time data, using streaming analytics to monitor demand changes, supplier performance, and market dynamics as they happen. This approach transforms inventory planning from a quarterly exercise into a continuous process. IoT-enabled sensors and RFID tags provide constant visibility into inventory levels, allowing AI to spot discrepancies between expected and actual stock levels. When issues arise, the system triggers immediate corrective actions.

Real-time data also highlights missed sales opportunities caused by stockouts, a blind spot for many traditional forecasting methods. AI identifies these gaps and adjusts buffer stock to prevent future occurrences. Retailers leveraging AI-driven forecasting have reported a 65% reduction in product unavailability and a 20% cut in logistics costs. This seamless flow of data lays the groundwork for tailored service levels.

Service Level Customisation

AI offers a more nuanced approach to service level management. Instead of applying a one-size-fits-all target - like a 95% service level across all products - AI enables businesses to customise targets for individual SKUs. By running scenario simulations, AI models balance service levels, inventory costs, and profit margins. This allows companies to determine when increasing service levels no longer provides a worthwhile return on investment.

| Feature | Traditional Buffer Calculation | AI-Driven Buffer Customisation |

|---|---|---|

| Data Input | Historical sales averages | Real-time data, market signals, and IoT feeds |

| Service Level | Fixed target (e.g., 95%) | Dynamic targets tailored to SKU profitability |

| Adjustment Frequency | Monthly or quarterly | Weekly or real-time |

| Risk Assessment | Manual and intuition-based | Automated scenario simulations and "what-if" modelling |

sbb-itb-499c055

AI Models vs Traditional Methods

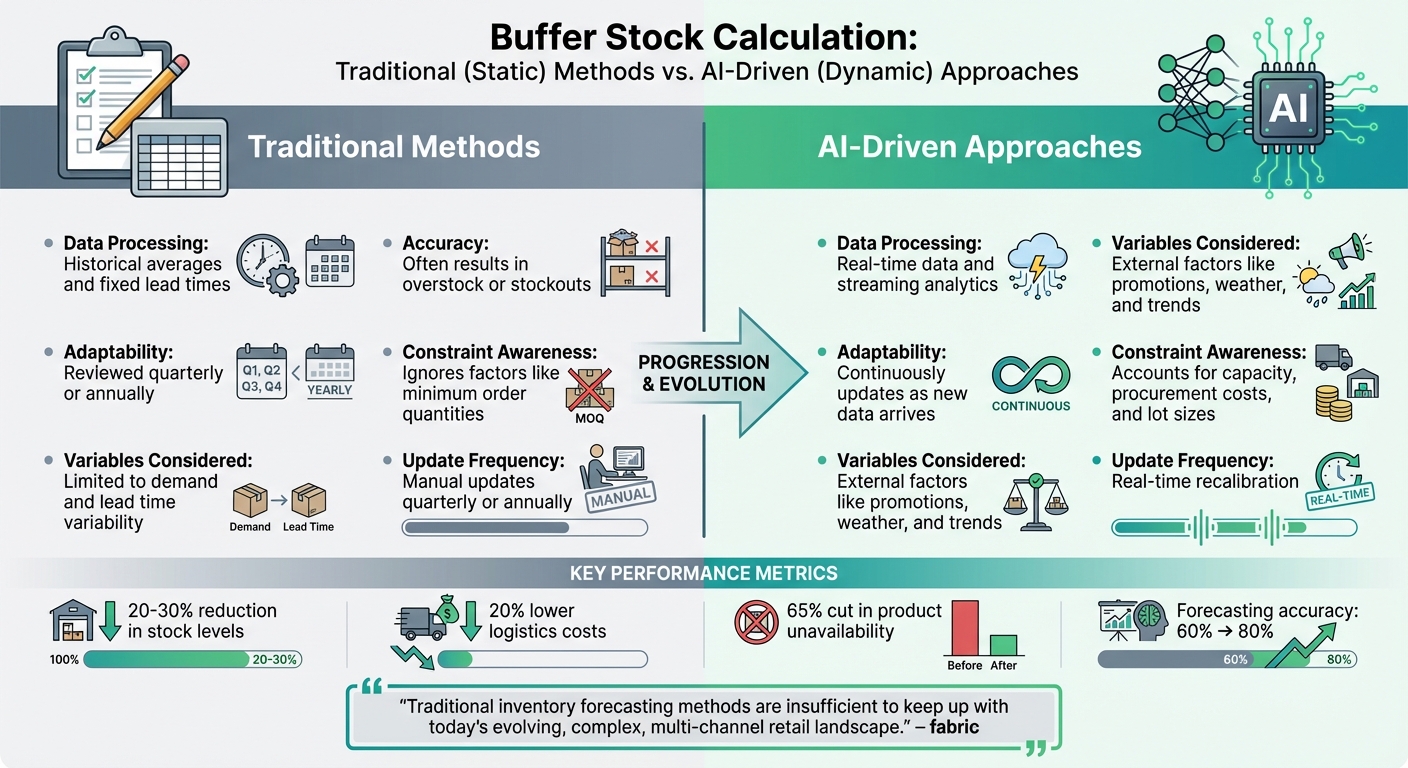

Traditional vs AI-Driven Buffer Stock Calculation Methods Comparison

Building on earlier discussions about AI's ability to adapt in real time, let’s take a closer look at how it stacks up against traditional approaches. Traditional buffer stock methods rely on fixed parameters that are typically updated only once every quarter or year. On the other hand, AI-driven systems recalibrate continuously - sometimes daily - as they process new data. This allows AI models to respond swiftly to demand spikes, supplier delays, and market changes, whereas traditional methods often lag behind, relying on outdated assumptions. AI systems can analyse a wide range of variables simultaneously, such as real-time demand signals, supplier reliability, promotional schedules, weather forecasts, and even social sentiment, to fine-tune buffer stock with far greater precision. The leap from static averages to dynamic, data-driven analysis highlights the stark contrast between these two approaches.

"Traditional inventory forecasting methods are insufficient to keep up with today's evolving, complex, multi-channel retail landscape." – fabric

Here’s a practical example: In July 2025, a manufacturing firm used an AI system to assess an item where traditional methods, applying a Z-factor of 2.33, recommended a 110,000-unit buffer. The AI system, however, flagged that the item's high minimum order quantity rendered this buffer unnecessary. By eliminating the excess, the company saved £30,000 in inventory costs over the course of a year.

Static vs Dynamic Approaches

| Factor | Traditional (Static) Methods | AI-Driven (Dynamic) Approaches |

|---|---|---|

| Data Processing | Relies on historical averages and fixed lead times | Processes real-time data and streaming analytics |

| Adaptability | Reviewed quarterly or annually | Continuously updates as new data arrives |

| Variables Considered | Limited to demand and lead time variability | Considers external factors like promotions, weather, and trends |

| Accuracy | Often results in overstock or stockouts | Optimises inventory to match current conditions |

| Constraint Awareness | Ignores factors like minimum order quantities | Accounts for capacity, procurement costs, and lot sizes |

| Update Frequency | Manual updates quarterly or annually | Real-time recalibration |

The financial advantages of these dynamic systems are striking. AI-powered inventory management has been shown to reduce stock levels by 20–30%, lower logistics costs by up to 20%, and cut product unavailability by 65%. In contrast, traditional methods, which often use a Z-factor of 2.33 for a 99% service level or 3.09 for a 99.9% service rate, fail to adapt to real-world constraints, making them less effective in today’s fast-paced environments.

Benefits of Using Forthcast for Buffer Stock Optimisation

Reducing Inventory Costs and Stockouts

Forthcast takes the guesswork out of inventory management with its dynamic daily recalculations. By constantly adjusting order quantities based on real-time demand and supplier data, it ensures your stock levels align with actual needs. The platform analyses multiple factors - like lead time variability and supplier reliability - to fine-tune orders. It even identifies anomalies in historical data, such as one-off bulk orders, and filters them out to prevent inflated buffer estimates.

Here’s the impact: AI-driven supply chain tools like Forthcast can improve inventory levels by 35%. Businesses using AI in inventory management have reported a total inventory reduction of up to 30%. Forthcast’s automated ordering system, guided by AI-calculated thresholds, ensures timely replenishment without overstocking. The results? A 20% drop in logistics costs and a 15% cut in procurement expenses, translating into better operational efficiency and higher profitability.

"AI allows inventory-based businesses to shift from reactive to predictive strategies, and from guesswork to precision." – Jeffrey Porter, StockIQ

And these cost benefits go hand in hand with improved forecasting accuracy.

Improved Forecast Accuracy

Forthcast doesn’t just save costs; it sharpens forecasting precision. By constantly monitoring performance metrics like Mean Absolute Percentage Error (MAPE) and Forecast Bias, the platform refines its models as fresh data rolls in. Its machine learning algorithms achieve an impressive 95% demand satisfaction rate while keeping stock levels lean. Tracking forecast biases also helps businesses pinpoint where predictions consistently miss the mark, enabling targeted corrections.

The system’s ability to capture seasonal patterns and promotional spikes boosts its accuracy to around 89.8%. This continuous refinement ensures that businesses are always working with the most reliable demand predictions.

And when it comes to promotions or seasonal changes, Forthcast takes things a step further.

Adjustments for Promotions and Seasonality

Forthcast simplifies the complexities of seasonal and promotional demand. It factors in promotional schedules and seasonal trends to adjust buffer stock calculations automatically. So, whether you’re planning a major sale or preparing for a holiday rush, the system ensures your stock levels are ready.

Using seasonal indexing, Forthcast calculates the ratio of peak demand to average demand, scaling buffer stock accordingly. It also uses real-time demand sensing to integrate signals from multiple sources, predicting the impact of promotions on specific items. This ensures that stock is allocated where it’s needed most, preventing stockouts during high-demand periods and avoiding excess inventory when promotions end. The result? Smarter use of working capital all year round.

Conclusion

Buffer stock calculation has undergone a significant transformation, moving away from static spreadsheets to dynamic, AI-powered systems. The old approach, which relied on historical averages and fixed reorder points, often left businesses exposed - either struggling with stockouts during unexpected demand spikes or dealing with surplus inventory when market conditions shifted. Now, AI models take a more nuanced approach, considering factors like promotions, seasonal trends, supplier reliability, and even weather patterns. This enables businesses to set buffer levels that strike the right balance between meeting service goals and optimising capital use. It's a game-changer in inventory management.

The numbers speak for themselves. Companies adopting AI-driven forecasting have seen forecasting accuracy jump from 60% to 80%, while overall inventory levels have dropped by 20% to 30%. Product unavailability has been slashed by up to 65%, and logistics costs have fallen by 20%, with procurement expenses reduced by 15% as well. These improvements highlight the tangible benefits of this shift.

Forthcast takes this a step further by continuously refining buffer stock calculations through real-time data, supplier performance tracking, and anomaly detection. Instead of relying on outdated assumptions, the platform adapts dynamically to evolving business needs, turning buffer stock into a strategic asset rather than just a safety net.

FAQs

How does AI enhance buffer stock calculation compared to traditional methods?

AI transforms buffer stock calculation by leveraging machine learning to process real-time sales data, external influences, and multiple input channels. This approach enables it to adjust dynamically to shifting demand patterns, ensuring safety stock levels are more precise and adaptable.

Traditional methods often depend on static historical averages or cumbersome spreadsheets. In contrast, AI-driven models continuously refine themselves, helping you maintain an optimised inventory. The result? Fewer stockouts, less excess stock, smoother supply chain operations, and stronger profitability.

What are the benefits of using AI-powered systems for managing inventory?

AI-driven inventory systems bring a fresh edge to stock management, far surpassing traditional methods in efficiency and cost savings. By processing real-time sales data, supply chain signals, and external influences, these systems generate precise demand forecasts. This accuracy helps businesses cut down on stockouts, avoid surplus inventory, and trim overall expenses.

What’s more, AI strengthens supply chain resilience by dynamically adjusting reorder points and buffer stock levels to account for demand surges, seasonal patterns, or unexpected disruptions. This forward-thinking strategy keeps operations running smoothly, enhances service quality, and boosts flexibility in unpredictable markets. For e-commerce retailers, platforms like Forthcast wrap all these advantages into one package, offering tools like automated reorder alerts, SKU-level analytics, and anomaly detection to fine-tune inventory management and increase profitability.

How do AI models adjust to real-time changes in demand and supply?

AI models stay in tune with real-time market changes by analysing live data streams like sales trends, website activity, social media insights, weather updates, supplier lead times, and promotional calendars. This information feeds into machine learning algorithms that constantly update to reflect current conditions. Techniques such as Long Short-Term Memory (LSTM) networks and Gradient-Boosting Machines are particularly effective at spotting patterns, sudden changes, or disruptions, ensuring the models remain highly responsive.

These systems can dynamically recalculate buffer stock levels, adjust reorder points, flag unusual trends, and even recommend alternative sourcing strategies when necessary. By doing so, inventory planning becomes a forward-thinking, data-informed process. This approach helps minimise the chances of stock shortages or excess inventory, keeping operations both efficient and flexible.